Simplified Financing Options at Westpac

In today’s fast-paced financial world, finding the right financing solution can be overwhelming. Westpac, one of Australia’s leading banks, aims to simplify this process with its range of financing options.

Whether you’re looking to buy a home, start a business, or manage your personal expenses, Westpac has you covered. This article will guide you through Westpac’s financing offerings, helping you make informed decisions about your financial future.

Understanding Westpac’s Financing Products

Westpac offers a diverse array of financing products designed to meet various needs and financial goals. From personal loans to mortgages and credit cards, the bank provides tailored solutions for individuals and businesses alike.

Let’s explore the main categories of financing options available at Westpac:

- Personal Loans

- Home Loans

- Business Loans

- Credit Cards

- Car Loans

Each of these products comes with its own set of features, benefits, and eligibility criteria. By understanding these options, you can choose the financing solution that best aligns with your financial objectives and circumstances.

Personal Loans: Flexible Financing for Your Needs

Westpac’s personal loans offer a versatile way to finance major purchases, consolidate debt, or cover unexpected expenses. These loans come with competitive interest rates and flexible repayment terms, making them an attractive option for many borrowers.

Unsecured Personal Loans:

These loans don’t require collateral and are ideal for smaller amounts or shorter terms.Secured Personal Loans:

By offering an asset as security, you may be eligible for lower interest rates and higher loan amounts.

When applying for a personal loan with Westpac, consider factors such as the loan amount, interest rate, repayment period, and any associated fees. The bank’s online personal loan calculator can help you estimate your repayments and choose the most suitable loan option.

Home Loans: Making Homeownership a Reality

For many Australians, owning a home is a significant life goal. Westpac’s range of home loans caters to first-time buyers, investors, and those looking to refinance their existing mortgages.

The bank offers various types of home loans to suit different needs:

- Variable Rate Home Loans:

These loans offer flexibility and the potential to benefit from interest rate decreases. - Fixed Rate Home Loans:

Ideal for those who prefer stability in their repayments, with rates locked in for a set period. - Split Loans:

A combination of variable and fixed rate loans, offering a balance between flexibility and certainty.

Westpac’s home loan specialists can guide you through the application process and help you choose the most suitable option based on your financial situation and goals. The bank’s online mortgage calculator is also a valuable tool for estimating your borrowing capacity and potential repayments.

Business Loans: Fueling Your Entrepreneurial Dreams

Westpac understands the unique financial needs of businesses and offers a range of loan products to support entrepreneurs and established companies alike. Whether you’re looking to start a new venture, expand your existing business, or manage cash flow, Westpac has financing solutions to help you achieve your business goals.

- Business Term Loans:

Ideal for long-term investments or major purchases. - Business Lines of Credit:

Flexible financing that allows you to access funds as needed. - Equipment Finance:

Specifically designed for purchasing business equipment and machinery.

When considering a business loan from Westpac, it’s essential to have a clear business plan and financial projections. The bank’s business banking specialists can help you navigate the application process and choose the most appropriate financing option for your business needs.

Credit Cards: Convenient Financing at Your Fingertips

Westpac offers a diverse range of credit cards to suit various lifestyles and spending habits. From low-rate cards for everyday purchases to premium cards with travel benefits, there’s an option for every type of cardholder.

Some key features of Westpac credit cards include:

- Rewards programs

- Balance transfer offers

- Low or zero annual fees (on select cards)

- Complimentary insurance (on premium cards)

When choosing a Westpac credit card, consider factors such as your spending patterns, desired rewards, and ability to pay off the balance. The bank’s online credit card comparison tool can help you find the card that best matches your needs and financial situation.

Car Loans: Driving Your Dreams Forward

For many, owning a car is a necessity or a long-held aspiration. Westpac’s car loans provide a straightforward way to finance your vehicle purchase, whether you’re buying a new or used car.

The bank offers competitive interest rates and flexible repayment terms to make your car ownership dreams a reality.

- Secured Car Loans:

Using the vehicle as collateral, these loans often come with lower interest rates. - Unsecured Personal Loans for Cars:

Offering more flexibility but potentially higher interest rates.

When applying for a car loan with Westpac, be prepared with information about the vehicle you intend to purchase and your financial details.

The bank’s car loan calculator can help you estimate your repayments and choose the most suitable loan option.

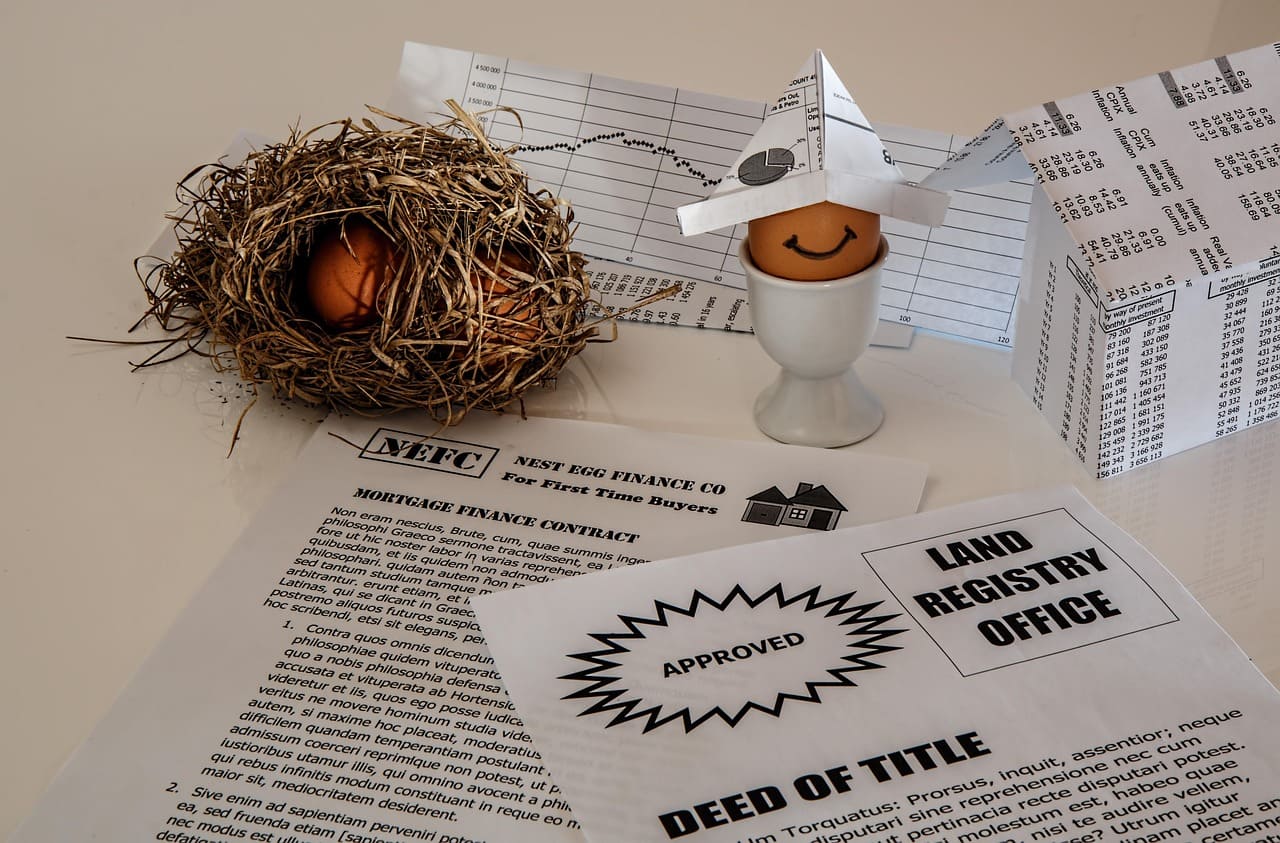

Source: Pixabay

Source: PixabayConclusion

Westpac’s range of financing options provides solutions for various financial needs and goals. From personal loans and mortgages to business financing and credit cards, the bank offers products designed to help you achieve your financial objectives.

By understanding the different financing options available and using Westpac’s online tools and calculators, you can make informed decisions about your financial future. Remember to consider your personal circumstances, financial goals, and repayment capacity when choosing a financing solution.

Whether you’re looking to buy a home, start a business, or simply manage your day-to-day expenses, Westpac’s financing options can help you navigate your financial journey with confidence.

FAQs

- What credit score do I need for a Westpac personal loan?

Westpac doesn’t disclose a specific credit score requirement, but a good credit history improves your chances of approval. - Can I apply for a Westpac home loan online?

Yes, Westpac offers online home loan applications, making the process convenient and accessible. - What documents do I need for a Westpac business loan application?

Typically, you’ll need business financial statements, tax returns, and a business plan for a Westpac business loan application. - How long does it take to get approved for a Westpac credit card?

Online applications can receive a response within minutes, while full approval may take a few business days. - Does Westpac offer pre-approval for car loans?

Yes, Westpac provides pre-approval for car loans, allowing you to shop with confidence knowing your budget.